How to Avoid Sanctions Risks

A recent advisory issued by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), U.S. Department of State and U.S. Coast Guard warns the entire shipping industry of the sanctions risks associated with North Korea’s deceptive shipping practices.

The OFAC maintains comprehensive sanctions against the Democratic People’s Republic of Korea (DPRK). This includes not only a list of designations against members of the ruling regime and its economic assets, but also a prohibition on any transactions involving the country after the issuance of Executive Order 13722 in March of 2016.

While Congress’ recent actions against North Korea garnered less media coverage than those against Russia, the Countering America’s Adversaries Through Sanctions Act of 2017 significantly adds to the United States’ sanctions toolkit:

- Making certain designations mandatory and not at the discretion of the Executive.

- Requiring the Department of Homeland Security to publish a list of vessels engaged in trade with North Korea and deny them entry into the United States.

- Mandating the Executive to implement additional sanctions against those who employ North Korean labor.

North Korean sanctions are more challenging to enforce than other programs the United States has implemented historically, such as those against Iran or Syria. The complexity of these new sanctions only emphasizes the need for due diligence and extensive understanding of North Korea’s covert practices. North Korea has limited trading partners and a history of covert actions, including employing co-opted nationals to maintain ledgers on behalf of the regime. Additionally, North Korea gains much of its proceeds from illicit activities, such as fraudulent reinsurance schemes, arms sales and forced labor.

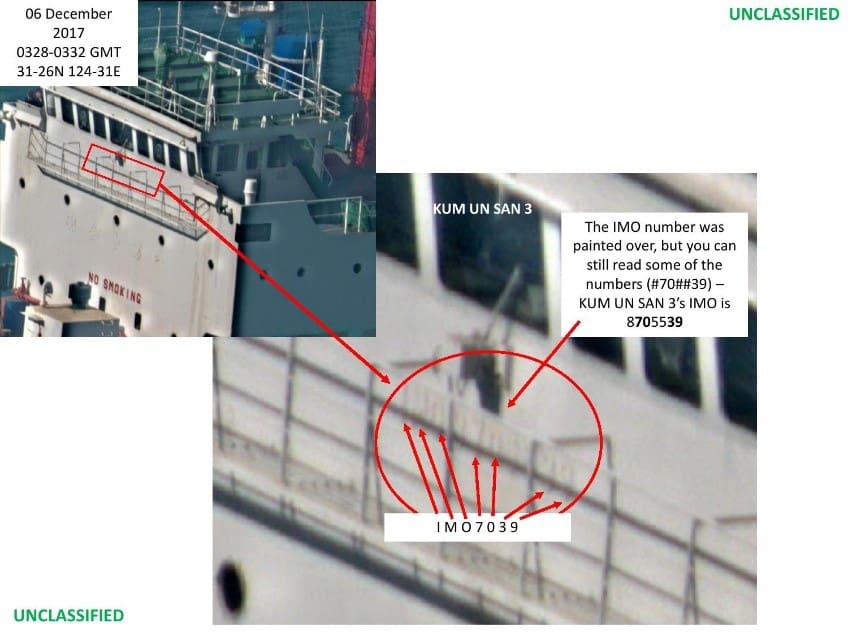

Figure 1

The Kim regime has perfected its evasion practices by conducting shipping-related transactions as to obfuscate the true North Korean nexus of the transaction. The OFAC recently issued an advisory to the shipping industry that warns of these evasive practices, noting that North Korea frequently:

- Physically alters the identity of its ships under a different flag (Figure 1).

- Falsifies documentation such as bills of lading

- Manipulates or deactivates shipboard monitoring devices.

- Conducts ship-to-ship transfers of oil between North Korean vessels and other third-party vessels.

The OFAC advisory further suggests several methods to determine if a shipment appears suspicious. These include:

- Reviewing shipping documents.

- Understanding your international partners and communicating your compliance commitments.

- Using open-source information to determine if onboard monitoring equipment has been disabled and to verify that the vessel actually exists.

While this guidance lays the foundation for a good compliance program, several other actions will ensure a firm’s compliance with sanctions regulations and reduce the possibility of reputational damage.

Track and Screen Vessels

Firms that have significant shipping activities should be prepared to screen their vessels, their owners (including beneficial owners), manager and ISM manager, as well as to track their vessels’ movement activity. Understanding where a vessel is and ensuring that the listed vessel is genuine can help minimize sanctions risk, prevent fraud and save your firm from significant operational losses.

There are systems available, such as Pole Star Space Application’s PurpleTrac, that allow users to add a vessel and instantly screen it against a robust series of watchlists provided by Dow Jones. Additionally, integration services are also available that further assimilate with specific systems and processes. Lloyds List Intelligence, for instance, allows its users to manually look up vessel information and AIS details.

It’s important to supplement this screening process by not just screening the vessels on the bill of lading, but also using carriers’ track-trace functionality to determine if the goods were transshipped or moved from one ship to another. Transshipment is common in the industry, but each additional vessel needs the same amount of scrutiny as the initial vessel.

Look for AIS Anomalies

Automated Identification Systems (AIS) are transponders that broadcast a ship’s location. Originally used for collision avoidance, compliance departments and investigators have repurposed them to track a vessel. However, it’s not a foolproof system. As the OFAC advisory notes, AIS transponders can be turned off with the flip of a switch and spoofed with some basic programming to either broadcast as a different ship or broadcast false coordinates. One way to counter this tactic is to look for periods where a vessel “goes dark” and stops broadcasting or to compare the expected activity with the broadcasted routes. It’s not enough to simply check if the vessel made a port call to North Korea or Iran. The bad guys have gotten smarter, and we now need to look harder at these transactions.

Implement Risk Indicators

In addition to the guidance provided by the OFAC, companies can take many other steps to reduce their exposure to evasive activities. For example, many North Korean activities can be risk assessed so that the higher-risk transactions receive extra scrutiny. Here are some helpful tips:

- Dalian, a Chinese city located across Korea Bay, is a key port for North Korean shipping and home to many North Korean trading firms. While it is a major Chinese transportation hub that serves numerous legitimate businesses, tankers involved in ship-to-ship transfers have originated from this port in the past. Many DPRK shipping firms are registered under a Hong Kong shell company but operate in the care of a Dalian-based company.

- Dandong, a Chinese city on the border of North Korea, is the primary entry and exit point for overland goods into the DPRK. Any transaction whose final destination is in Dandong should be considered high-risk.

- North Korea has been known to use vessels displaying the flags of Cambodia, Tanzania, Mongolia and Moldova. Even when Tanzania officially deregistered North Korean vessels, North Korean ships continued to fly the Tanzanian flag. Any shipment involving a vessel flying these flags should be treated as high-risk.

As OFAC enhances its guidance, it will seek to hold companies increasingly accountable for identifying and preventing evasion of sanctions regulations. Paying close attention to OFAC guidance and adopting risk-based practices for screening can reduce your company’s exposure to violations.

Julie Myers Wood is Chief Executive Officer for Guidepost Solutions. She focuses on regulatory compliance and investigative work and has significant experience as a monitor on issues related to sanctions and anti-money laundering for global entities. Prior to joining the private sector, Ms. Wood served as Head of Immigration and Customs Enforcement for the U.S. Department of Homeland Security, leading its largest investigative component and the second largest investigative agency in the federal government. She can be reached by email at

Julie Myers Wood is Chief Executive Officer for Guidepost Solutions. She focuses on regulatory compliance and investigative work and has significant experience as a monitor on issues related to sanctions and anti-money laundering for global entities. Prior to joining the private sector, Ms. Wood served as Head of Immigration and Customs Enforcement for the U.S. Department of Homeland Security, leading its largest investigative component and the second largest investigative agency in the federal government. She can be reached by email at